42 zero coupon bonds advantages

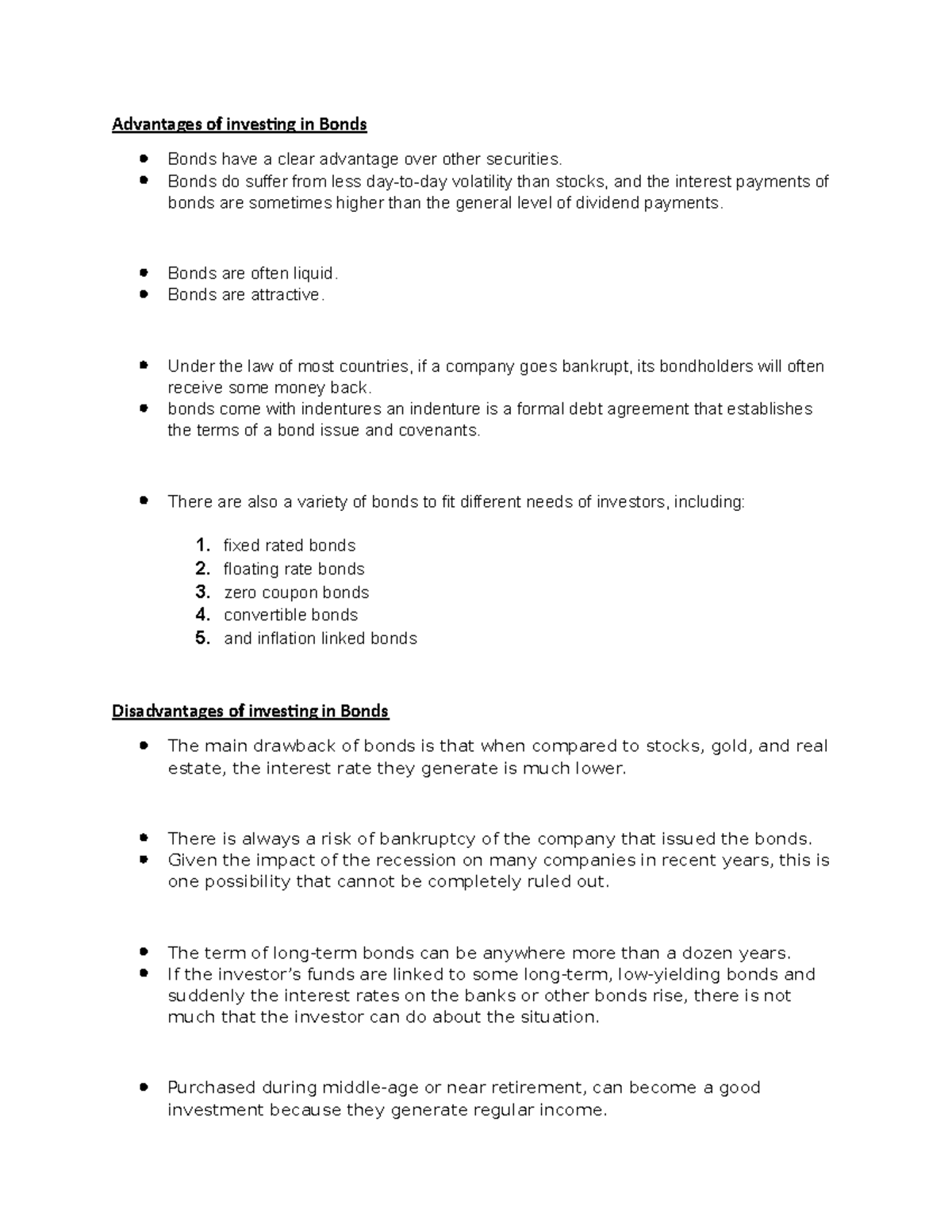

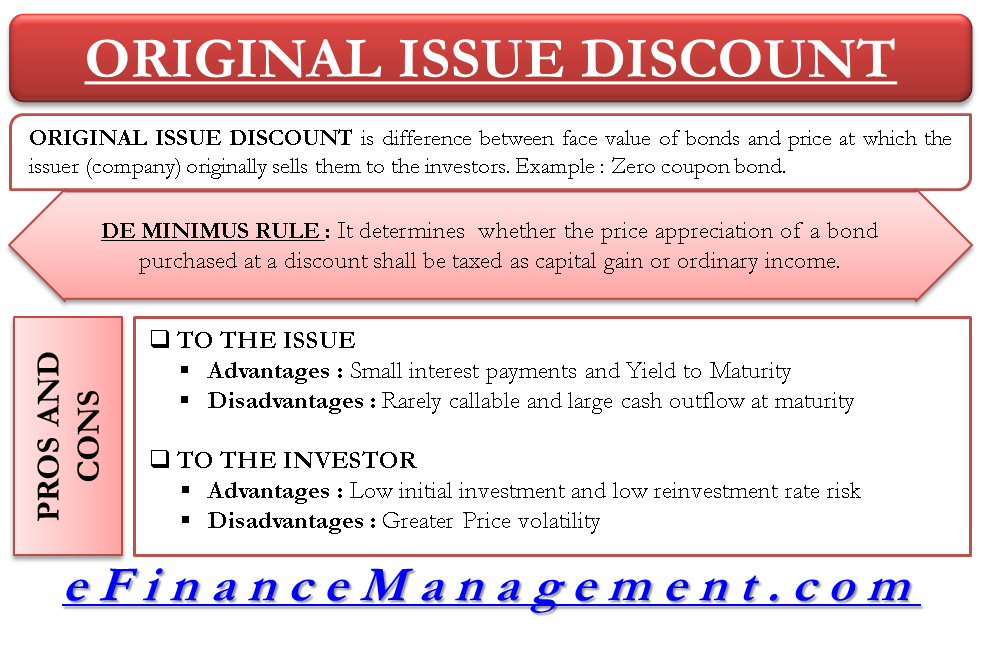

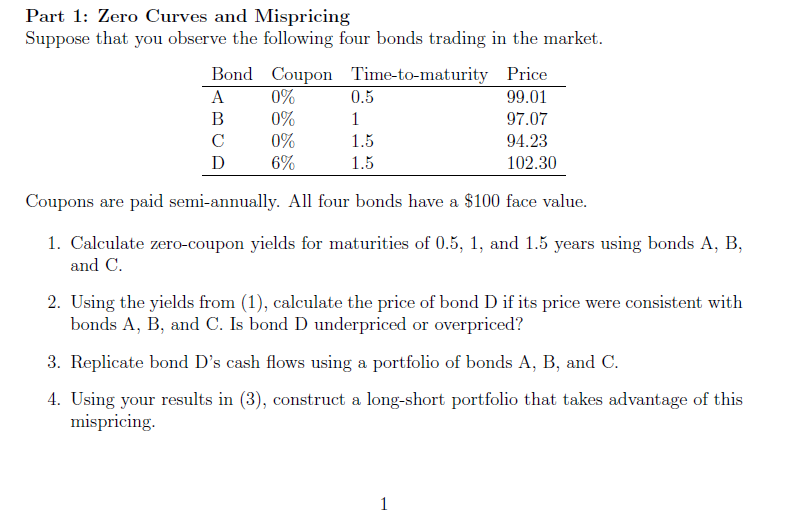

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero-Coupon Bonds and Taxes - Investopedia Zero-coupon bonds can help investors to avoid gift taxes, but they also create phantom income tax issues. The Difference for Investors Long-term zero-coupon bond investors gain the...

Zero coupon bonds advantages

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

Zero coupon bonds advantages. ebook - Wikipedia An ebook (short for electronic book), also known as an e-book or eBook, is a book publication made available in digital form, consisting of text, images, or both, readable on the flat-panel display of computers or other electronic devices. Although sometimes defined as "an electronic version of a printed book", some e-books exist without a printed equivalent. › government-bondsGovernment Bonds: Types, Benefits & How to invest - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. Stock Quotes, Business News and Data from Stock Markets | MSN … Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ... News and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

› news-and-insightsNews and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more What are Zero Coupon Bonds? | Features, Advantages, Disadvatages Advantages of Zero Coupon Bonds Long-Term in Nature Conservation of Cash No Reinvestment Risk Disadvantages of Zero Coupon Bonds Taxability Loss of Interest Highly Fluctuation Market Prices High Repayment Risk Return of Investors Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment. Government Bonds: Types, Benefits & How to invest - BondsIndia The many advantages that the different type of Government Bonds provide attracts individual investors from various section of our society. Government Bonds are a long-term investment ranging from 4 to 40 years. ... Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero ...

Zero-Coupon Bond - an overview | ScienceDirect Topics In the US market zero-coupon bonds or "zeros" were first issued in 1981 and initially offered tax advantages for investors, who avoided the income tax charge associated with coupon bonds. 6 However the tax authorities in the US implemented legislation that treated the capital gain on zeros as income, thus wiping out the tax advantage. The ... What Is a Zero-Coupon Bond? - Investopedia Regular bonds, which are also called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. A zero-coupon bond does not pay interest but instead... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a... Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Invest in Zero Coupon Bond at Yubi | Learn All About It Advantages of Zero-Coupon Bonds. Zero coupon bonds assure a fixed amount of money on maturity. They are a reliable & secure source of fixed returns for investors and an excellent choice for portfolio diversification. A zero coupon bond is immune to short-term market ups & downs. They do not offer any fixed income based on an interest rate ...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc.

Bond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the full face value at maturity. Callable Bonds: These bonds let the issuer pay off the debt—or “call ...

Advantages and Risks of Zero Coupon Bonds - India Dictionary What is a zero coupon bond example? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills. are an example of a zero-coupon bond. If the bond's stated interest rate is greater than those anticipated by the present bond ...

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) Advantages #1 - Predictability of Returns This offers predetermined returns if held till maturity, which makes them a desirable choice among investors with long term goals or for those intending assured returns and doesn't intend to handle any type of Volatility usually associated with other types of Financial Instruments such as Equities, etc.

The EU Mission for the Support of Palestinian Police and Rule of Law EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ...

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

› en-us › moneyStock Quotes, Business News and Data from Stock Markets | MSN ... Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ...

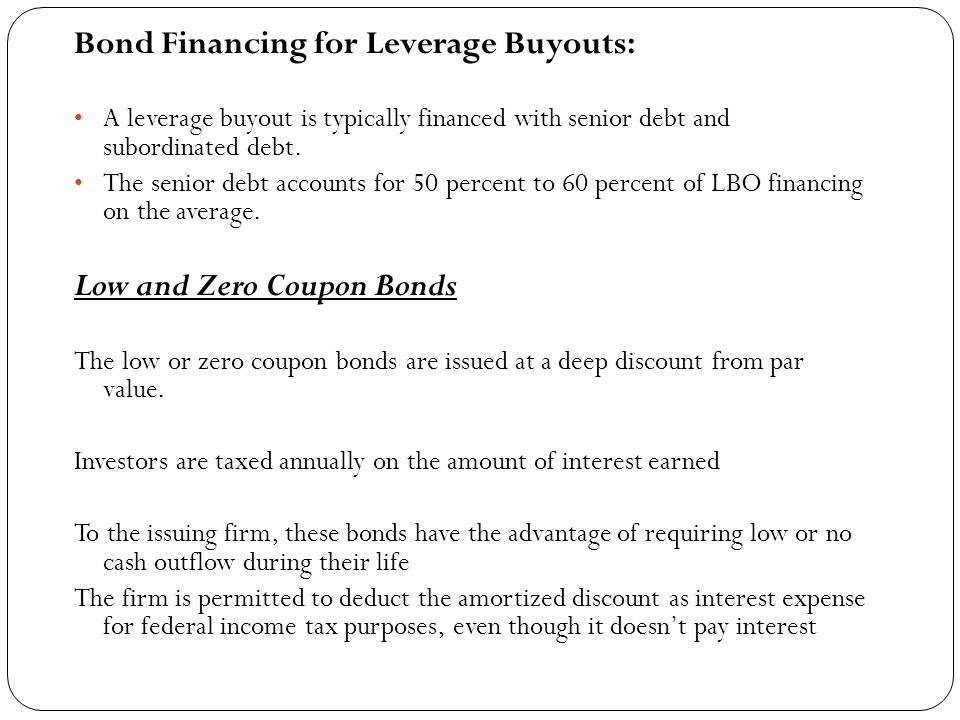

Zero coupon bonds what are the advantages and - Course Hero 1. Zero-Coupon Bonds. What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds? ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest ...

en.wikipedia.org › wiki › Ebookebook - Wikipedia An ebook (short for electronic book), also known as an e-book or eBook, is a book publication made available in digital form, consisting of text, images, or both, readable on the flat-panel display of computers or other electronic devices.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "42 zero coupon bonds advantages"