38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Bond Coupon Interest Rate: How It Affects Price - Investopedia Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon payments remain static. 2 For... Bonds | FINRA.org Most agency bonds pay a semiannual fixed coupon and are sold in a variety of increments, generally requiring a minimum initial investment of $10,000. ... it will quite likely price its securities to reflect the higher interest rate. Those new bonds pay more interest. What happens to the Treasury bonds you bought a couple of months ago at the ...

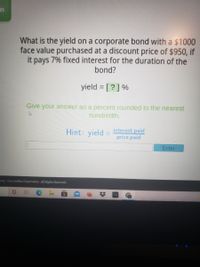

If the yield on a fixed coupon bond goes up - AnswerData If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

(Solved) - Fixed Income BMC module. When investors doubt the ... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the... 3. Asset accounts normally have credit balances and revenue accounts ... journal entry to record this transaction will include a debit to Cash. 1. If a company provides services to a customer on credit the selling company should credit Accounts Receivable. 2. When a company bills a customer for $600 for services rendered, the journal entry to record this transaction will include a $600 debit to Services Revenue. 3. Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. › glossary › fixed-incomeFixed Income Glossary - Common Fixed Income Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ... KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the ... The correct option is c). No, the price goes down. The payments are fixed. Explanation: The Yield and Price of a fixed-coupon bond have an inverse relationship where if the Yield goes up, the Price of the bond goes down. Since Yield reflects the required rate of return investors expect based on the risk of the bond, therefore, its price shows that. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions If you buy a bond for $1,000 and receive $45 in annual interest payments, your coupon yield is 4.5 percent. This amount is figured as a percentage of the bond's par value and will not change during the lifespan of the bond. Current yield is the bond's coupon yield divided by its market price. At Par - Overview, Bond Yields and Coupon Rates, Importance The coupon rate can be defined as the interest rate it yields. Par values are generally fixed at 100, in lieu of 100% of the face value of the $1,000 bond. So, when a bond is quoted or said to be trading at 100, it means that the bond is trading at 100% of its par value, which is $1,000. However, if a bond is said to be trading at 85, it means ...

Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ... If the yield on a fixed coupon bond goes up If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down. If the yield on a fixed-coupon 'bond goes up, does the...get 5 No,... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d. No, the price goes down. The payments are fixed. Sep 16 2022 | 09:58 AM | Solved What is the price of a $1,000 par value bond with a 6%...ask 5 If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No,... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d.

› bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market. How the Fed's rate increase may affect your bond portfolio - CNBC For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925. › ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ... (Solved) - When investors doubt the creditworthiness of a borrower ... The correct answer is Prices goes down, yield go up. There is an inverse relationship between the price of a bond and its yield and when creditworthiness is in doubt, it lowers the price of the bond and simultaneously increases the yield. Let us try to understand this in the example below:-. • Suppose an investor buys a bond with an annual ...

› investing › how-to-investHow to Invest in Bonds | The Motley Fool Nov 14, 2022 · Also, if prevailing interest rates on newly issued bonds go down, then the value of an existing bond at a higher rate goes up. Yields, or the interest rate a bond pays, and bond prices tend to ...

coupon and yield : r/bonds - reddit Coupon refers to the stated interest rate of the bond. A 5% coupon is $50, etc. Yield refers to the % received buying the bond and can be measured on different end-points (yield to maturity, yield to worst, etc.), and is influenced by the purchase price of the bond (if you buy below par, the yield will be higher than the coupon, if you buy ...

What are the four policy issues in the pay model? What...ask hint 5 If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d. No, the price goes down. The payments are fixed.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

High Yield Bonds: Definition, Types, and How to Invest - Yubi The interest rate or coupon rate is permanently fixed, and if the market interest rates increase, corporate bond prices fall. This is because investors of fixed-income securities will no longer buy a corporate bond that offers low returns. Bonds with extended maturity periods also possess higher interest rate risk and higher inflation risk.

Coupon Bond - Guide, Examples, How Coupon Bonds Work If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments

Bond ratings classify bonds based on: interest rate,...ask hint 5 There are two categories of bonds based on the risk of default, including: bond investments.... Solution.pdf Previous Next If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up.

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Yield And Interest Rate - InterestProTalk.com Bond Ks coupon payment is still 5% as its based on par, but the current yield declines from 5% to 4.76% . The yield goes down because the buyer had to pay more for the bond. Whoever owns the bond at maturity will receive the par value. If interest rates increase 1% instead, the cost of borrowing would increase for the issuer.

Bond ETFs And Rising Rates Finally Explained - Bankeronwheels.com On 19th September 2020, IEF Bond ETF quoted at 121.67 with a yield to maturity of 0.75%. Using the Bond ETF Calculator, let's simulate the following scenario for iShares IEF Bond ETF: Starting yield to maturity of the ETF is 0.75%. Rates rise over 2 years at a rate of 2% per annum.

en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia At the time of issue of the bond, the coupon paid, and other conditions of the bond, will have been influenced by a variety of factors, such as current market interest rates, the length of the term and the creditworthiness of the issuer. These factors are likely to change over time, so the market price of a bond will vary after it is issued.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

Why Do Bond Prices Go Down When Interest Rates Rise? - The Balance Bonds compete against each other on the interest income they provide. When interest rates go up, new bonds come with a higher rate and provide more income. When rates go down, new bonds have a lower rate and aren't as tempting as older bonds. The bad news for bondholders is that fixed-rate bond issuers can't increase their rates to the same ...

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet A yield is a measure of the bond's performance that is obtained by dividing the coupon by the market price of the fixed income instrument - which is 100 at par, but can fluctuate up or down. If a yield increases from the original yield at par - which is equal to the coupon - the price of the bond has decreased.

Another milestone: The yield advantage for EE Savings Bonds has ... I Bonds pay an interest rate based on two factors: 1) the fixed rate, which is 0.0% and 2) the variable rate, which is currently annualized at 9.62% for six months. Because the fixed rate is 0.0%, we say that I Bonds purchased today have a "real yield" of 0.0%, meaning they will track future inflation, but not exceed it.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the bond trades for, the interest payments will always be $20 per year. For example, if...

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

3. Asset accounts normally have credit balances and revenue accounts ... journal entry to record this transaction will include a debit to Cash. 1. If a company provides services to a customer on credit the selling company should credit Accounts Receivable. 2. When a company bills a customer for $600 for services rendered, the journal entry to record this transaction will include a $600 debit to Services Revenue. 3.

(Solved) - Fixed Income BMC module. When investors doubt the ... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the...

:max_bytes(150000):strip_icc()/simple_bond_math_for_fixed-coupon_corporate_bonds-5bfc35a346e0fb00517dce6d.jpg)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

![[OC] I compressed 30 years of US interest rate history in one minute and 22 seconds for someone at the IMF](https://external-preview.redd.it/dJmqhCjG6AQ2EwwGej3oM9ZL_N4ux_iGxHch6shncrs.png?format=pjpg&auto=webp&s=6bf6fd47fe79b4507e6beb251e424d05d6c22ec7)

Post a Comment for "38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"