39 is yield to maturity the same as coupon rate

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of issuance, as determined by the issuing entity. Most bonds have par values of $100 or $1,000. Yield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · Is Yield to Maturity the Same as Coupon Rate? The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn’t ...

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond...

Is yield to maturity the same as coupon rate

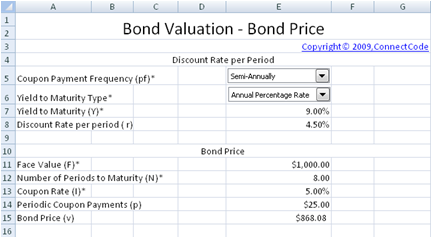

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Difference Between Yield to Maturity and Coupon Rate The coupon rate is 5.25% with a term to maturity of 4.5 years. Yield to Maturity is calculated as, Yield to Maturity = 5.25 + (100-102.50/4.5) / (100+102.50/2) = 4.63% Yield to Maturity can be identified as an important yardstick for an investor to understand the amount of return a bond will generate at the end of the maturity period.

Is yield to maturity the same as coupon rate. How to calculate yield to maturity in Excel (Free Excel Template) 12/09/2021 · Coupon Rate, rate = 6%; Coupons per Year, nper = 4 (quarterly) Years of Maturity = 10; Now, you went to a bond rating agency (Moody’s, S&P, Fitch, etc.) and they rated your bond as AA+. More about the bond rating. But the problem is: when you tried to sell the bond, you see that the same rated bond is selling with 7.5% YTM (yield to maturity). Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. What is the difference between coupon rate and yield to maturity? Why ... Answer (1 of 6): In order to answer this, its important to get some definitions right and some history right. In the past, interest rates were much higher. In the 80s you could earn 10%+ on government dated. Today, its ~3% or less. When you speak of a bond, you're speaking of several things (see...

Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return … Is the Yield to Maturity on a Bond the Same Thing As the Required ... In contrast to yield to maturity, required return starts with yield and works backward to determine the price. For example, say a corporation needs to raise capital, and it is preparing to issue 10-year, $1,000 bonds at a coupon rate of 5 percent. When it comes time to sell the bonds, however, similar investments are paying a 9 percent annual ... Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang What is the major difference between a coupon rate and yield of maturity? The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Yield to Maturity (YTM) - Wall Street Prep The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA We also refer to coupons like the "coupon rate", "coupon percent rate" and "nominal yield". Yield to Maturity is the total return an investor will earn by purchasing a bond and holding it until its maturity date. Yield to maturity is a long-term bond yield and expresses in terms of an annual rate. Yield to Maturity vs Coupon Rate: What's the Difference If you purchase the bond at face value, the YTM and the coupon rate are the same. Otherwise, the YTM increases or decreases depending on whether you've purchased a discount or premium bond. Compare the Yield to Maturity vs Coupon Rate Before Purchasing Bond Investing your money is not an action you should take lightly. Yield To Maturity: What It Is And Why It's Important - IQ Calculators At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR ( Internal Rate of Return) on any investment. Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion.

Solved Is the yield to maturity on a bond the same thing as | Chegg.com The yield to maturity is the rate which when used to discount the coupon payments and the… View the full answer Transcribed image text : Is the yield to maturity on a bond the same thing as the required return?

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

FIN 221 Exam 1 Flashcards | Quizlet 17. Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. Which of the following statements is CORRECT? a. Bond A's capital gains yield is greater than Bond B's capital gains yield. b. If the yield to maturity for both bonds ...

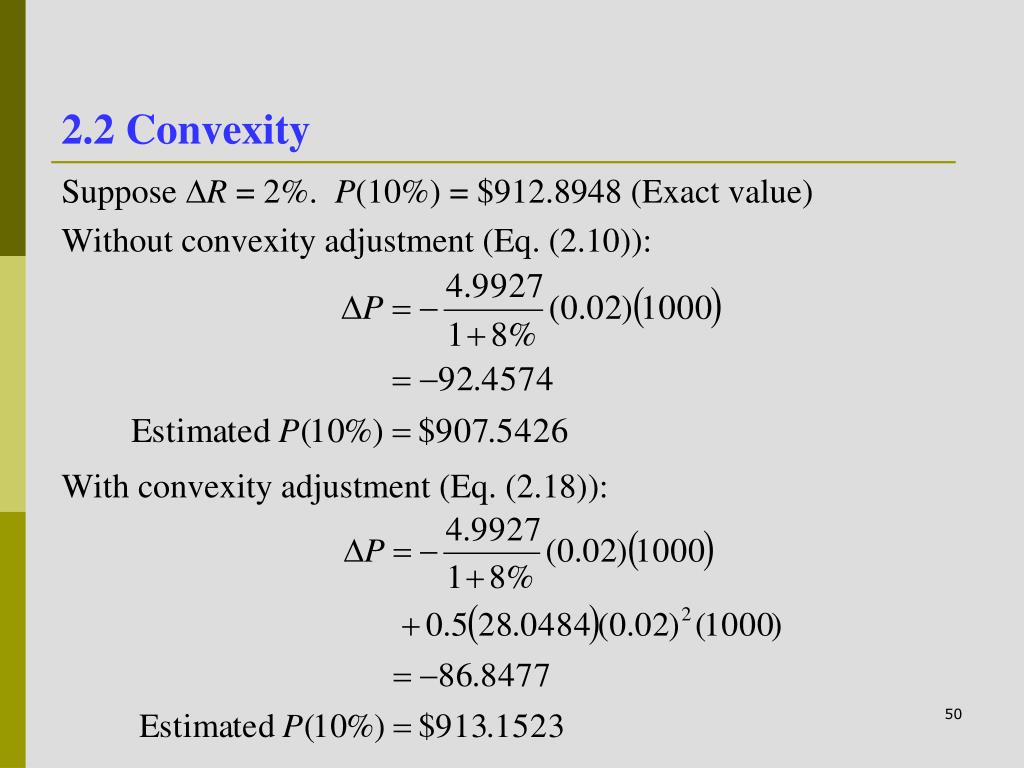

Solved Is the yield to maturity on a bond the same thing as - Chegg This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. What is the coupon rate on the bond then?

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If a bond's purchase price is equal to its par value, then the coupon rate, current yield, and yield to maturity are the same. 1 When discussing bonds, it is important to note the many different...

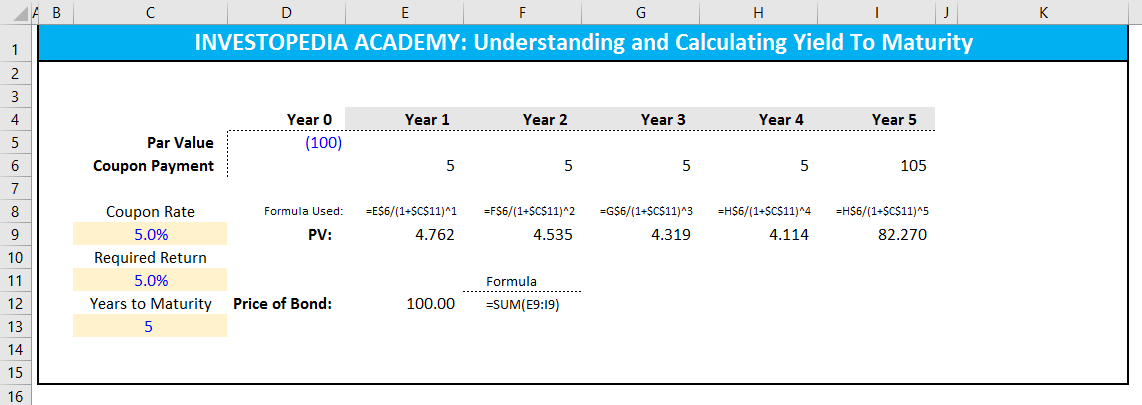

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity Calculator Inputs. Current Bond Trading Price ($) - The price the bond trades at today. Bond Face Value/Par Value ($) - The face value of the bond, also known as the par value of the bond. Years to Maturity - The numbers of years until bond maturity.; Bond YTM Calculator Outputs. Yield to Maturity (%): The converged upon solution for the yield to maturity of the …

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The interest rate of a bond is not the same as its coupon rate. Let's understand this with an example. Mr Ananth buys a bond at INR 1,000 (face value), and the coupon rate is 10%. ... A bond's price has an inverse relationship to its yield to maturity rate. As interest rates rise, there is a demand for greater returns. Therefore, the price ...

Post a Comment for "39 is yield to maturity the same as coupon rate"