39 yield to maturity of coupon bond

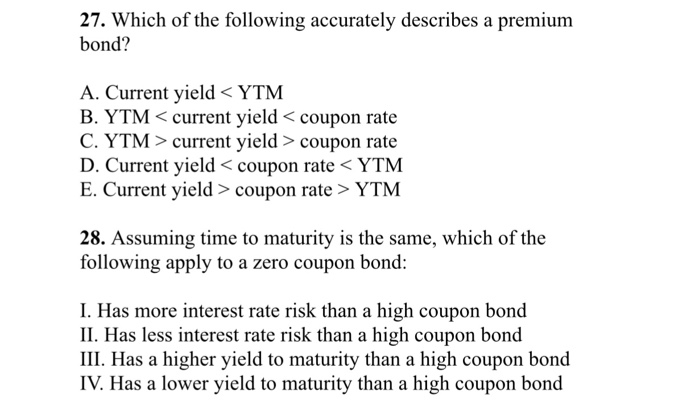

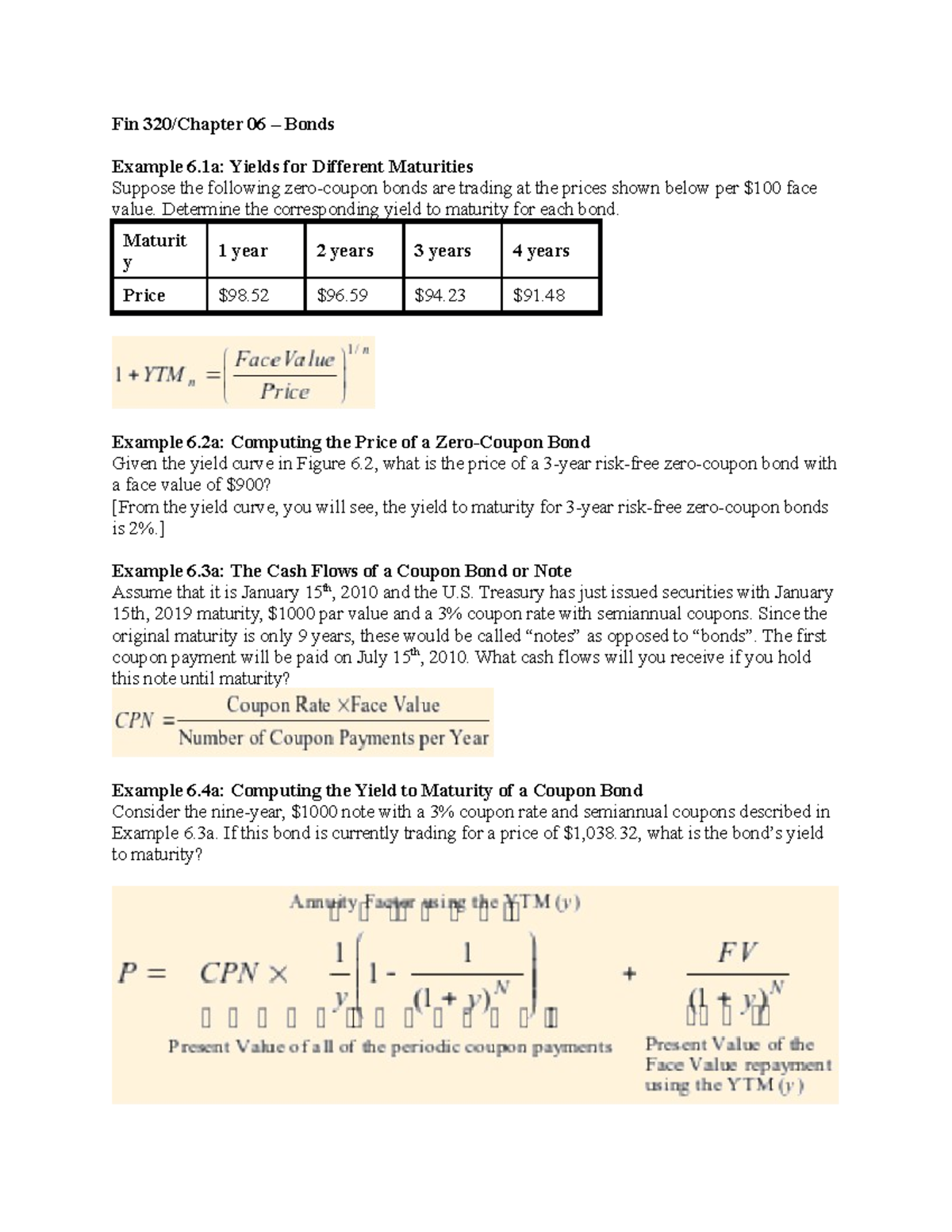

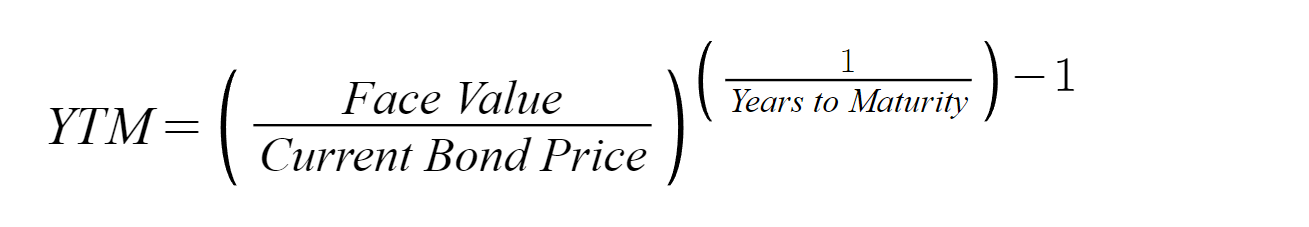

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Yield to Maturity (YTM) of an annual coupon bond - YouTube Learn how to calculate yield to maturity (YTM) of an annual coupon bond. @RK varsity

Yield to maturity of coupon bond

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to maturity of coupon bond. home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ... Treasury Yield: What It Is and Factors That Affect It - Investopedia 25.05.2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ... How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ...

Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. › terms › tTreasury Yield: What It Is and Factors That Affect It May 25, 2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Yield to Call (YTC) Calculator - DQYDJ On this page is a bond yield to call calculator.It automatically calculates the internal rate of return (IRR) earned on a callable bond assuming it's called at the first possible time. Importantly, it assumes all payments and coupons are on time (no defaults). Also, find the approximate yield to call formula below. Like with Yield to Maturity (YTM), Yield to Call is an iterative calculation.

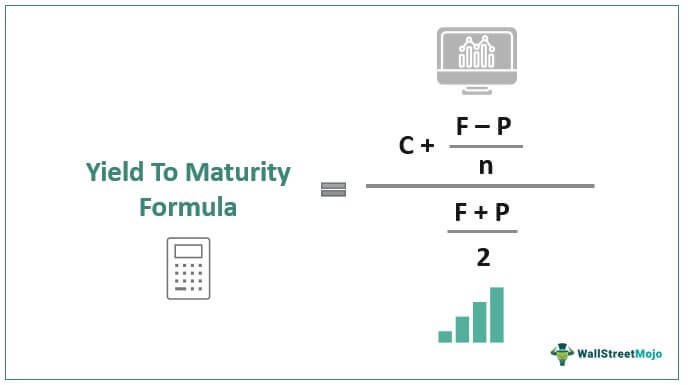

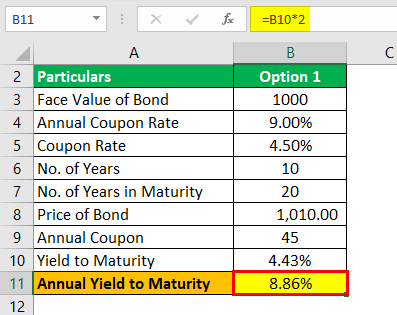

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Use the below-given data for the calculation of yield to maturity. Coupon on the bond will be $1,000 * 7.5% / 2 which is $37.50, since this pays semi-annually. Yield to Maturity (Approx) = ( 37.50 + (1000 - 1101.79) / (20 * 2) )/ ( (1000 + 1101.79) / 2) YTM will be - › coupon-bond-formulaCoupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 – (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Calculator (Step-by-Step) The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on ...

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

Yield To Maturity Coupon Bond - bizimkonak.com Yield to Maturity (YTM) - Definition, Formula, Calculation … CODES (1 days ago) The current yield of bond= Annual coupon payment/current market price read more, which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of its bond term. In other words, a … Visit URL. Category: coupon codes Show All Coupons

Yield to Maturity (YTM): Formula and Calculator (Step-by-Step) The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are then reinvested at the …

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If this same bond is purchased for $800, then the current yield becomes 7.5% because the $60 annual coupon payments represent a larger share of the purchase price. Special Considerations A...

Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a fin...

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par Value: $1000; Years to Maturity: 3; Annual Coupon Rate: 0%; Coupon Frequency: 0x a Year; Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%. Conclusion and Other …

When is a bond's coupon rate and yield to maturity the same? 13.01.2022 · Conversely, a bond purchased at a premium always has a yield to maturity that is lower than its coupon rate. Yield to maturity approximates the average return of the bond over its remaining term.

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change.

/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "39 yield to maturity of coupon bond"