42 coupon vs zero coupon bonds

Yield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds. For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. A ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

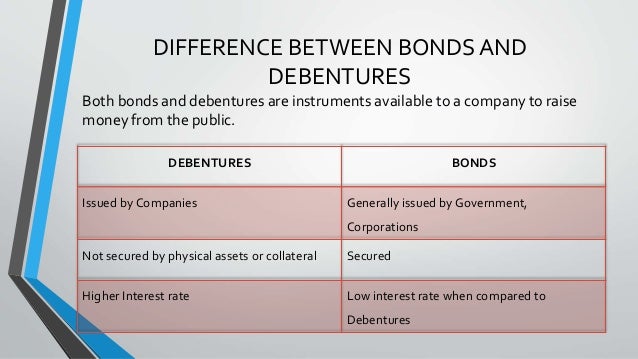

Stocks vs. Bonds: Differences and Similarities | Stock Analysis There are also so-called zero-coupon bonds, which pay no interest at all. Bonds issued by the US government (termed treasuries) pay interest twice per year. For example, a 10-year treasury bond might have a par value of $10,000 and a 2% coupon.

Coupon vs zero coupon bonds

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Deep Discount bonds and Zero Coupon Bonds - The Fixed Income Deep Discount bonds and Zero Coupon Bonds. In 1992 investors were drawn to exciting advertising by Industrial Development Bank of India (IDBI), a Central Government promoted Development Financial Institution, calling for subscription to its Flexi-Bonds. The terms were mouth-watering, offering bonds with a face value of Rs. 1 lakh for Rs. 2,700.

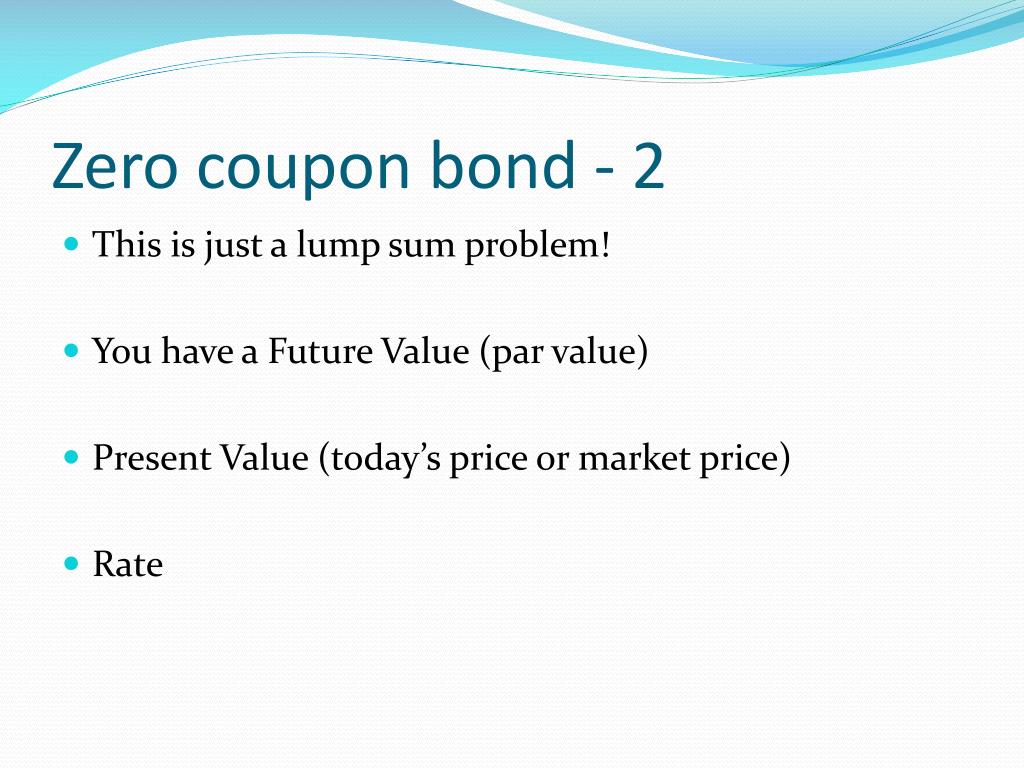

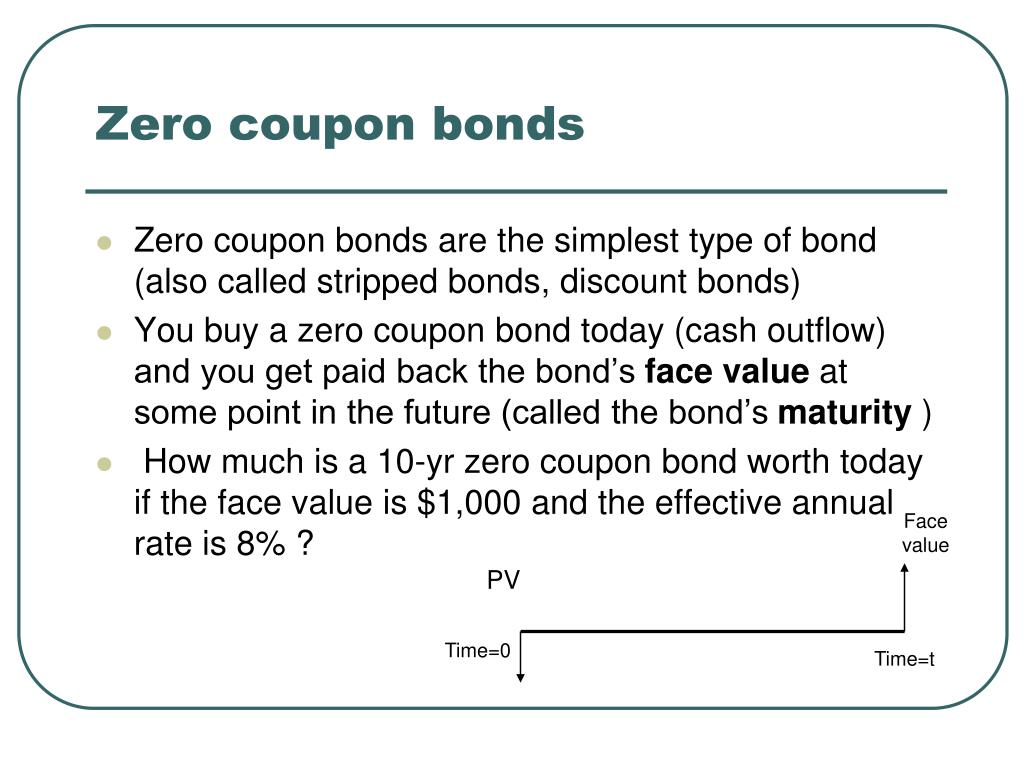

Coupon vs zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Numeraire: Money market vs zero coupon bond | QuantNet Community Q2: Normalized zero-coupon bond pays $1 at its maturity. Let P (t,T) denote the price of a ZC bond at time t that matures at time T. By a basic no-arbitrage argument, P (t,T) is related to the money market account via P (t, T) = E_t^Q [1/M (t,T)]. Q3: It is not that a fixed income instrument satisfies this SDE, it is simply that you could take ... › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Fixed Vs Floating Bonds - Which is Better Investment Option? - Scripbox These bonds have a fixed maturity date and interest rate for the duration of the bond. As a result, fixed-rate bonds provide investors with a consistent stream of income, referred to as coupon payments. On the other hand, floating-rate bonds have a variable coupon rate that depends on the benchmark rate (repo rate or reverse repo rate). Thus ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... United Kingdom Government Bonds - Yields Curve 22.08.2022 · The United Kingdom 10Y Government Bond has a 2.599% yield.. 10 Years vs 2 Years bond spread is -13.1 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in August 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation … What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Coupon vs Yield | Top 5 Differences (with Infographics) This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table. You may also have a look at the following articles – Coupon Rate and Interest Rate; Calculation of Convexity of a Bond; Bond Equivalent Yield; Zero-Coupon Bond Formula MC Explains | What is a 'zero-coupon, zero-principal' instrument? With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... Coupon Definition - Investopedia 02.04.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. › terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bonds - Contetra Zero-coupon bond (also known as discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have a "coupon rate," hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par ...

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom A zero-coupon bond is a preferred investment option since it is secured, especially if invested for the long term. Some of the benefits that these offers are: Predictable Returns: Since returns on zero-coupon bonds are the difference between maturity/face value and discounted face value, investors can predict returns on a zero-coupon bond. Low ...

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the life of the bond by being ...

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Some of the key bonds are Municipal bonds, Governments bonds, corporate bonds, Zero Coupons bonds, etc. Bonds also called fixed-income instruments. Example: Some of the key features of Treasury Bills are as listed below. T-Bonds are long-term investment bonds issued by the government to finance the ongoing operation of government services.

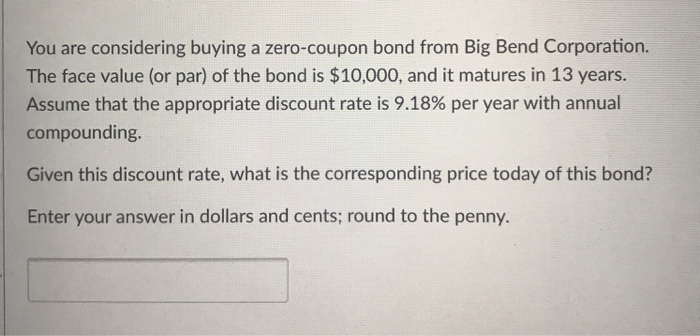

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

› treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Some of the key bonds are Municipal bonds, Governments bonds, corporate bonds, Zero Coupons bonds, etc. Bonds also called fixed-income instruments. Example: Some of the key features of Treasury Bills are as listed below. T-Bonds are long-term investment bonds issued by the government to finance the ongoing operation of government services.

EOF

Post a Comment for "42 coupon vs zero coupon bonds"