45 treasury bill coupon rate

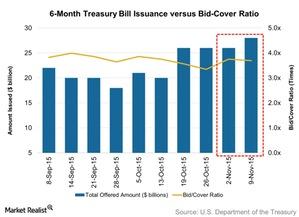

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 18 Jul 2022: 1807: 182 DAY BILL: 24.1461: 27.4615: 18 Jul 2022: 1807: 91 DAY BILL: 24.3735: 25.9550: 11 Jul 2022: 1806: 364 DAY BILL: 21.5625: 27.4900: 11 Jul 2022 ... Individual - Treasury Bills: Rates & Terms Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98.

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

Treasury bill coupon rate

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875%; Maturity 2032-05-15; Latest On U.S. 10 Year Treasury. Bond yields rise as yield curve inversion sends worrying recession signals 50 Min Ago CNBC.com. Price, Yield and Rate Calculations for a Treasury Bill Calculate … Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

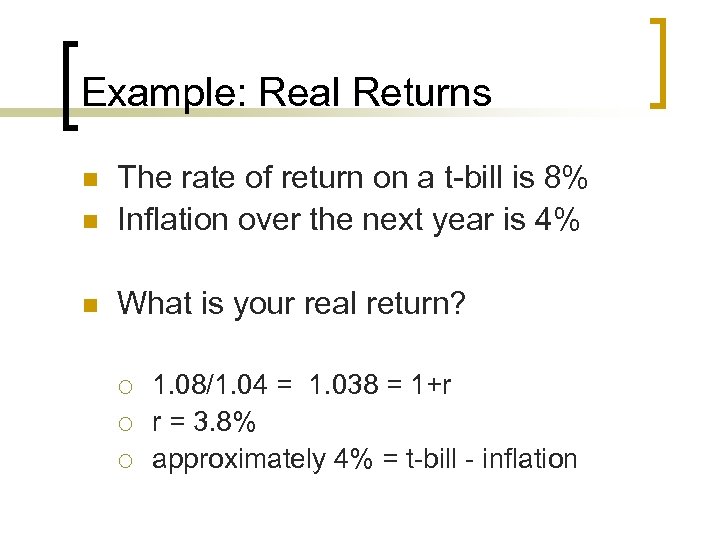

Treasury bill coupon rate. Treasury Bills (T-Bills) Definition - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face... 5 Year Treasury Rate - YCharts Jul 15, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 3.00%, compared to 3.18% the previous market day and 0.74% last year. PDF Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity For bills of more than one half-year to maturity i ... State Small Business Credit Initiative (SSBCI) | U.S. Department of … Jul 19, 2022 · SSBCI NEWS Recent SSBCI News and Announcements from the last 60 days: Treasury Approves Nine Additional State Plans to Support Underserved Entrepreneurs and Small Business Growth Through the State Small Business Credit Initiative (7/18/2022) Technical Assistance Deadline Extension for States, the District of Columbia, and Territories (Updated …

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) Should You Buy Treasuries? The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... Advantages and Risks of Zero Coupon Treasury Bonds The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular weekly T-bills are commonly issued with maturity dates of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks.

Featured Stories | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays.

Interest Rate Statistics | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... View the Daily Treasury Bill Rates ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30 ...

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

How Is the Interest Rate on a Treasury Bond Determined? This means that Treasury rates are very important. But it also means that Treasury rates are comparatively modest. As of early June 2020, the rate for a 10-year T-Bond was hovering around .66%. 5 ...

Treasury Bills (T-Bills) Definition - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Resource Center | U.S. Department of the Treasury 26 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 52 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 1 Mo. 2 Mo. 3 Mo. 20 Yr. 30 Yr.

Understanding Treasury Yields and Interest Rates For example, the 30-year mortgage rate historically runs 1% to 2% above the yield on 30-year Treasury bonds. 2. The Treasury yield curve (or term structure) shows the yields for Treasury ...

Frequently Asked Questions - U.S. Department of the Treasury The par yield curve is based on securities that pay interest on a semiannual basis and the yields are "bond-equivalent" yields. Treasury does not create or publish daily zero-coupon curve rates. Does the par yield curve only assume semiannual interest payment from 2-years out (i.e., since that is the shortest maturity coupon Treasury issue)? No.

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of July 14, 2022 is 2.96%.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Price, Yield and Rate Calculations for a Treasury Bill Calculate … Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875%; Maturity 2032-05-15; Latest On U.S. 10 Year Treasury. Bond yields rise as yield curve inversion sends worrying recession signals 50 Min Ago CNBC.com.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Post a Comment for "45 treasury bill coupon rate"