43 how to calculate coupon rate from yield

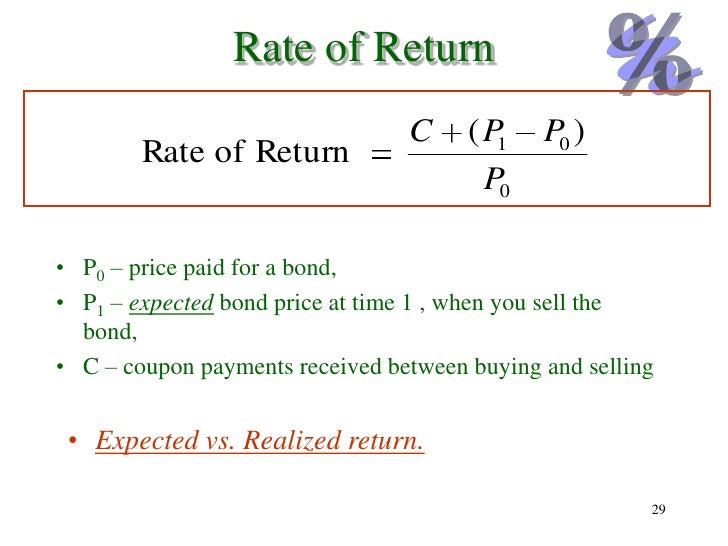

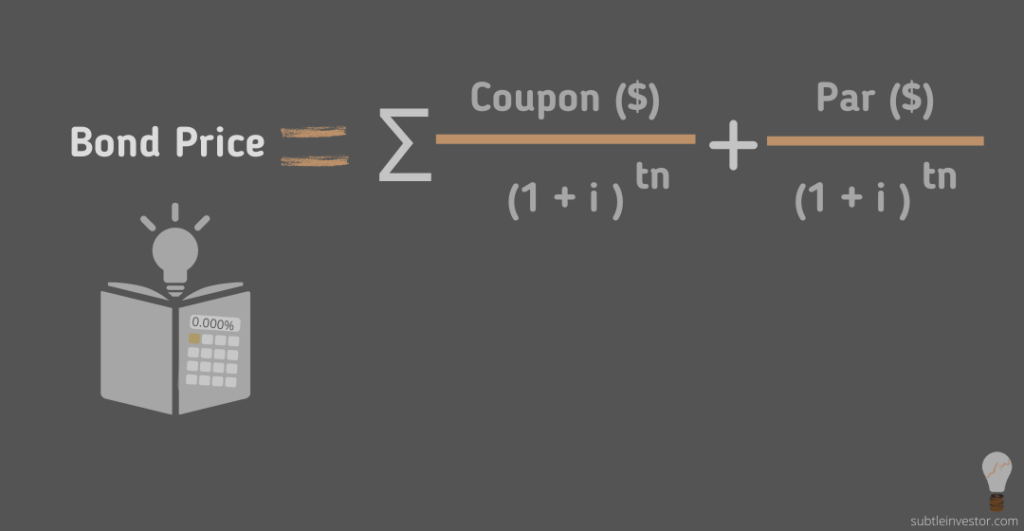

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Bond Yield Rate Vs. Coupon Rate: What's The Difference? The current yield compares the coupon worth to the current market price of the bond. Therefore, if a $1,000 bond with a 6% coupon worth sells for $1,000, then the current yield will be 6%. However, because of the market price of bonds can fluctuate, it is perhaps doable to purchase this bond for a price that is above or below $1,000.

› Calculate-After-Tax-YieldHow to Calculate After Tax Yield: 11 Steps (with Pictures) May 06, 2021 · For example, with the 6% corporate bond and the 28.8 percent marginal tax rate, your after-tax yield would be calculated using the following equation: = This calculations gives an after-tax yield of 0.0427, or 4.27%.

How to calculate coupon rate from yield

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. › current-yield-of-a-bondCurrent Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest.

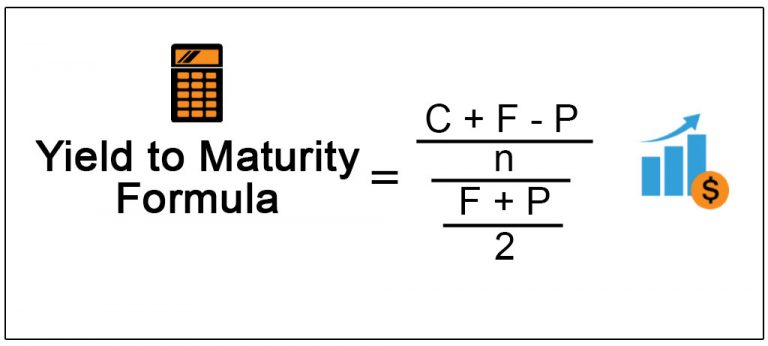

How to calculate coupon rate from yield. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds. Yield to Maturity (YTM) - Overview, Formula, and Importance What is the Yield to Maturity (YTM)? Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond.The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value ...

How do you calculate approximate yield? Besides, how do I calculate yield to maturity? For example, say an investor currently holds a bond whose par value is $100. The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What is a Coupon Rate? | Bond Investing | Investment U Another, more comprehensive way of looking at this, is to consider coupon rate vs. yield to maturity. Coupon Rate vs. Yield to Maturity. One of the most important metrics to use a bond's coupon rate is Yield to Maturity (YTM). Because the coupon remains fixed, investors can use it to calculate the total yield of a bond if held to maturity ... Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, and ...

› how-to-calculate-yield-toHow to calculate yield to maturity in Excel (Free Excel Template) Sep 12, 2021 · How to Calculate Yield to Maturity (YTM) in Excel 1) Using the RATE Function. Suppose, you got an offer to invest in a bond. Here are the details of the bond: Par Value of Bond (Face Value, fv): $1000; Coupon Rate (Annual): 6%; Coupons Per Year (nper): 2. The company pays interest two times a year (semi-annually). Years to Maturity: 5 years. What Is Coupon Rate and How Do You Calculate It? Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ... › knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · To get an initial approximation of a semi-annual bond yield, one simple method is simply to take the coupon rate on the bond to calculate the semi-annual bond payment and then divide it by the ... Yield To Maturity Vs. Coupon Rate: What's The Difference? To calculate the bond's coupon charge, divide the overall annual curiosity funds by the face worth. In this case, the overall annual curiosity cost equals $10 x 2 = $20. ... Yield to Maturity vs. Coupon Rate: An Overview When buyers think about shopping for bonds they want to take a look at two important items of data: the yield to maturity ...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate - YouTube The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

How do you calculate approximate yield? The yield to maturity formula is used to calculate the yield on a bond based on its current price ... and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market ... The effective annual interest rate is equal to 1 plus the nominal interest rate in percent divided by the number ...

› Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

Current Yield Formula | Calculator (Examples with Excel Template) The formula for the current yield of a bond can be derived by using the following steps: Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox How to Calculate Coupon Rate of a Bond? The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. ... Coupon Rate: Yield to Maturity (YTM) Face Value: 15%: 15%: Higher than the face ...

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Calculate Formula Excel Bond To How Price Search: How To Calculate Bond Price Formula Excel. Data must be entered in U 4 Make a CAPM in Excel Bond face value is 1000 A mutual fund with a 5% load, would have a cost basis of NAV plus a 5% commission Annual Coupon Rate is the yield of the bond as of its issue date Annual Coupon Rate is the yield of the bond as of its issue date.

Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

› current-yield-of-a-bondCurrent Yield of a Bond - Meaning, Formula, How to Calculate? = Annual coupon payment / Current market price = 100/ 950 = 10.53%; Scenario #2: Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest.

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

![Calculate fixed amount before tax calculation [#1612662] | Drupal.org](https://www.drupal.org/files/percentage-coupon.jpg)

Post a Comment for "43 how to calculate coupon rate from yield"